The Bernard Rodriguez Journal

Exploring the latest trends and stories in news and lifestyle.

Cyber Liability Insurance: Because Hackers Don’t Care About Your Business Plan

Protect your business from cyber threats—discover why cyber liability insurance is essential in a hacking world!

Understanding Cyber Liability Insurance: What Every Business Needs to Know

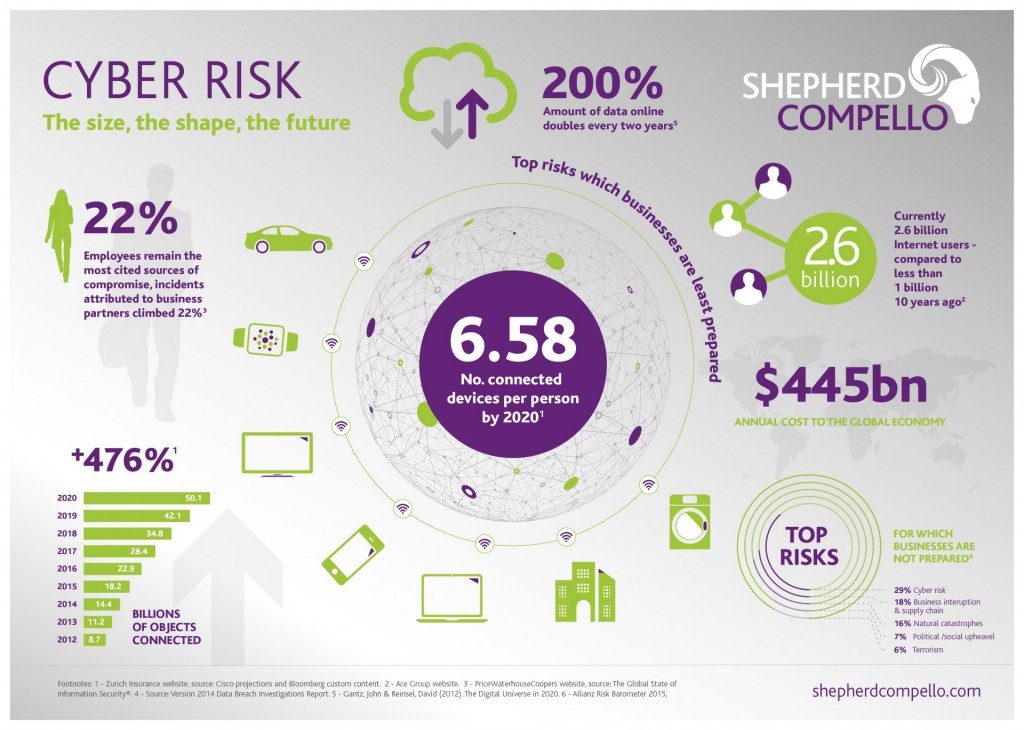

Cyber liability insurance is an essential component for any business operating in today's digital landscape. As cyber threats become increasingly sophisticated, it's crucial for businesses to protect themselves from potential financial losses resulting from data breaches, hacking incidents, and other cyber risks. This type of insurance helps cover costs related to data breaches, notification of affected customers, and even legal fees that may arise from cyber incidents. Without proper coverage, a single breach could prove devastating, forcing a business to close its doors.

When considering cyber liability insurance, businesses should be aware of several key factors. Firstly, it's vital to evaluate the specific risks faced by the organization, since different industries may have unique vulnerabilities. Secondly, understanding the terms of the policy is essential; this includes knowing what types of incidents are covered, the limits of coverage, and any exclusions that may apply. Finally, businesses should implement strong cybersecurity measures alongside their insurance policy, as many insurers require proof of these safeguards before issuing coverage. This comprehensive approach ensures that companies are not only financially protected but also proactive in preventing cyber threats.

Is Your Business Prepared for a Cyber Attack? The Importance of Cyber Liability Insurance

In today's digital landscape, the question Is Your Business Prepared for a Cyber Attack? is more critical than ever. Cyber attacks can severely impact businesses of all sizes, leading to financial loss, reputational damage, and legal liabilities. Being proactive in your cybersecurity measures is essential, but even with the best defenses, no company is fully immune. This is where cyber liability insurance comes into play. It provides a safety net by covering expenses related to data breaches, including crisis management, customer notification, and legal fees, thus allowing businesses to focus on recovery and continuity.

Moreover, having cyber liability insurance not only protects your business but also encourages a culture of security awareness within your organization. When businesses invest in this type of insurance, they often take a closer look at their existing security protocols, leading to improved defenses against potential threats. Important considerations for selecting the right policy include understanding coverage limits, evaluating specific risks your business faces, and ensuring compliance with industry regulations. In the end, asking yourself Is Your Business Prepared for a Cyber Attack? is not just about assessing your current cybersecurity measures, but also about securing peace of mind through the right insurance coverage.

Common Myths About Cyber Liability Insurance Debunked

Cyber liability insurance is often shrouded in myths that can lead businesses to underestimate the importance of this vital coverage. One common myth is that only large corporations are at risk for cyber incidents. In reality, small and medium-sized enterprises (SMEs) are increasingly targeted by cybercriminals due to their perceived lack of robust security measures. According to industry statistics, over 40% of cyber attacks are directed at SMEs, highlighting the necessity for businesses of all sizes to consider cyber liability insurance as a critical part of their risk management strategy.

Another widespread misconception is that cyber liability insurance covers all types of cyber incidents, including any and all penalties or fines incurred during a data breach. In truth, most policies have specific exclusions and conditions, making it crucial for businesses to thoroughly understand their coverage. Furthermore, not all policies cover incidents caused by employee negligence or insider threats. Businesses should carefully review their insurance policy and work with an experienced broker to tailor their coverage, ensuring they are adequately protected against the evolving landscape of cyber risks.