The Bernard Rodriguez Journal

Exploring the latest trends and stories in news and lifestyle.

Paws and Claws: Why Pet Insurance is Your Furry Friend's New BFF

Discover why pet insurance is more than just a safety net—it's your furry friend's essential BFF for health and happiness!

The Ultimate Guide to Pet Insurance: Protecting Your Furry Family Members

In today's world, pet insurance has become an essential consideration for every pet owner. As veterinary costs continue to rise, having a reliable safety net can provide significant peace of mind. Investing in pet insurance not only helps cover unexpected medical expenses but also encourages responsible pet ownership. With various plans available, it's crucial to evaluate your options carefully to find a policy that meets your unique needs and covers the veterinary care your furry family member deserves.

When selecting a pet insurance policy, there are several key factors to consider:

- Coverage Types: Ensure the policy covers accidents, illnesses, and routine care.

- Exclusions: Be aware of any conditions that are not covered by the policy.

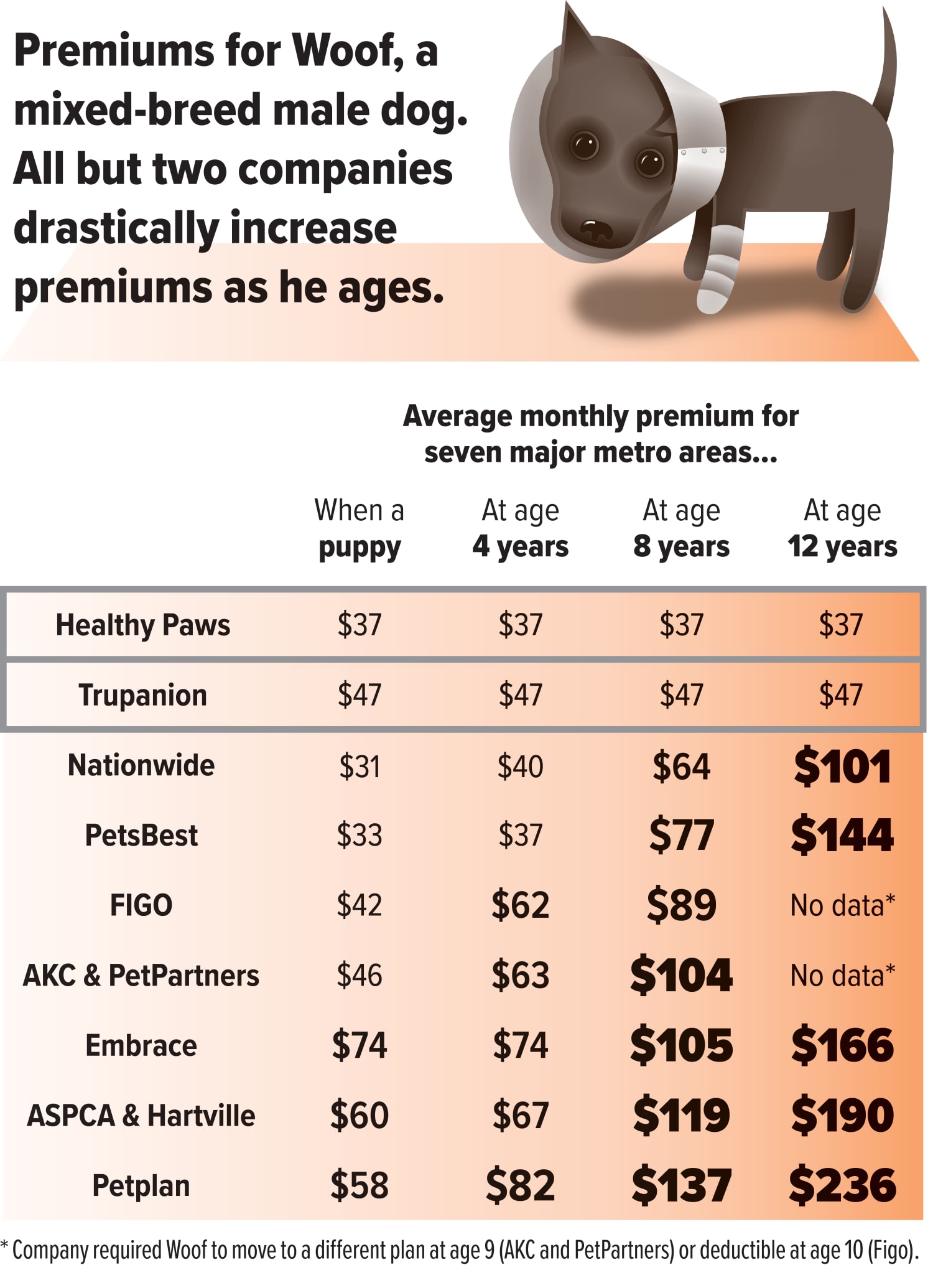

- Premiums and Deductibles: Analyze the costs involved and how they fit within your budget.

- Reputation of the Insurance Provider: Research customer reviews and claims processing efficiency to ensure reliability.

By understanding these aspects, you can make an informed decision to protect your beloved pet and maintain their health and happiness.

5 Reasons Why Pet Insurance is Essential for Your Cat or Dog

When it comes to caring for your beloved furry friend, pet insurance is a vital consideration. First and foremost, it provides financial protection against unexpected veterinary costs. Just like humans, pets can experience sudden illnesses or accidents that require immediate medical attention. According to a recent study, over 60% of pet owners faced unexpected veterinary bills averaging over $1,000. With pet insurance, you can alleviate the stress of these costs, allowing you to focus solely on your pet's health.

Secondly, pet insurance ensures access to the best veterinary care without compromising on quality due to financial constraints. It often covers routine check-ups, vaccinations, and preventive treatments, which are crucial for maintaining your pet's health. By investing in pet insurance, you are not only safeguarding your pet's well-being but also promoting a long, healthy life. In summary, having pet insurance is essential due to its financial benefits, peace of mind, and commitment to your pet's overall health.

Is Pet Insurance Worth It? Your Questions Answered

When it comes to deciding whether pet insurance is worth the investment, it's essential to consider the potential costs of veterinary care for your furry friend. Unexpected accidents or illnesses can lead to expensive medical bills, often ranging from hundreds to thousands of dollars. For instance, emergency surgeries or chronic conditions may require ongoing treatments that can strain your finances. By having pet insurance, you can mitigate these costs and ensure your pet receives the necessary care without the burden of high out-of-pocket expenses.

Another crucial aspect to consider is the peace of mind that pet insurance offers pet owners. Knowing that you are financially prepared for your pet's health emergencies can alleviate stress during difficult times. Many policies also provide coverage for routine veterinary visits and preventive care, which can help maintain your pet's overall health. Ultimately, the decision to invest in pet insurance depends on your pet’s specific needs, your financial situation, and your willingness to invest in your pet's health for years to come.